So, you want to add an extra Bi-monthly recurring payment starting from the 24th period. Now, for the second case, you’ve already made 20 payments, moreover, your monthly income has gone up.

#Mortgage calculator extra payment how to

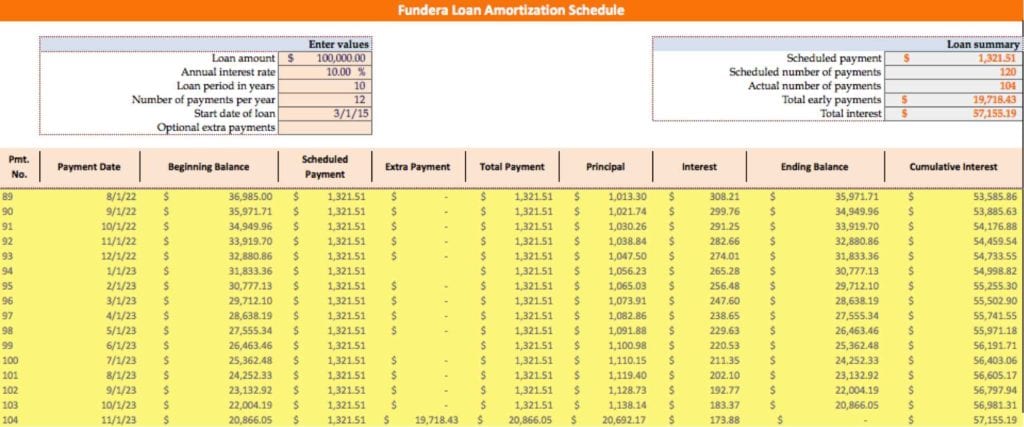

Read More: How to Calculate Monthly Payment on a Loan in Excel (2 Ways)Ĭase-2: Amortization Schedule with Regular Extra Payment (Recurring Extra Payment) Just like that, your amortization schedule is complete, it’s that simple! 📃 Note: In addition, the orange numbers denote those periods for which you should have cleared your payments. Then, the Total Period of the loan consists of 20 years or 240 months.Next, the Total Interest Paid over the maturity of the loan is $179,858.64.

Fourth, the Payment Type involves paying at the End of the Period.Third, the Annual Percentage Rate ( APR) consists of 6%.Second, the Loan Term spans over 20 years.Now, let us consider the following scenario, where you took a home loan (or for any other purpose) with the following details: Therefore, without further delay, let’s explore them one by one.Ĭase-1: Amortization Schedule with Regular Payment (PMT) Amortization Schedule with Irregular Extra Payment (Irregular Extra Payments).Amortization Schedule with Regular Extra Payment (Recurring Extra Payment).Amortization Schedule with Regular Payment (PMT).Indeed, this article will help you to pay off your mortgage in 3 diverse ways: Read More: How to Create Reverse Mortgage Calculator in Excelģ Ways to Calculate Amortization Schedule with Irregular Payments Lastly, other terms such as the Extra Amount You Plan to Add, Extra Payment (Recurring) Pay, and Extra Payment Starts from Payment No. In contrast, in some countries like Canada, though payment is monthly, interest compounding may be semi-annually. Simply put, if your payment frequency is monthly, then your interest is also compounded monthly. Interest Compounded: In general, it is equal to the payment frequency.

0 kommentar(er)

0 kommentar(er)